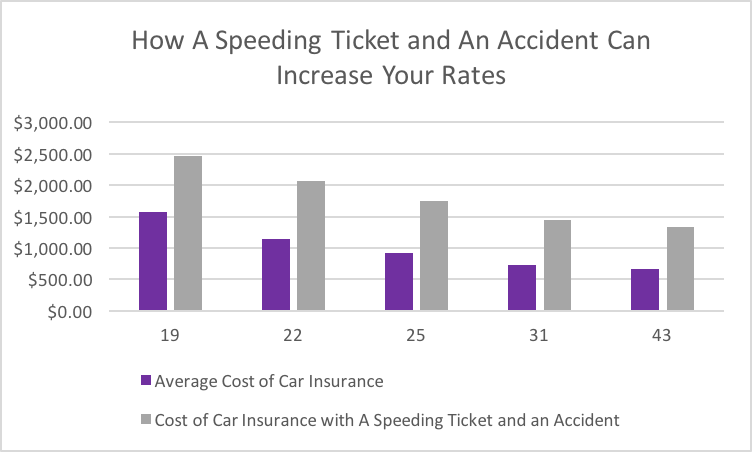

Figure out just how much insurance rises after an accident for different sorts of drivers in 2022., Vehicle Insurance Coverage Author, Jan 20, 2022 (auto).

Automobile mishaps occur, also to chauffeurs who aim to drive very carefully. Being entailed in an at-fault accident may be stressful, however having automobile insurance policy can aid cover residential property damage and spend for clinical costs, if required, to provide you some assurance. After an at-fault mishap, numerous chauffeurs fret about the boost to their auto insurance coverage costs.

The more damage you perform in your crash, the more you can normally anticipate to see your premiums raise. If you have a history of crashes, you can anticipate an also steeper rate walking since you will certainly look like a high-risk motorist. Comprehensive coverage action in when your auto is harmed, but it is not associated with a crash.

insurance company insurance company insurance affordable auto

insurance company insurance company insurance affordable auto

There are both advantages and disadvantages to changing insurance policy companies, so make certain you weigh both sides prior to you do it. Crash mercy programs, If you were signed up in an accident mercy program before your accident, you may be eligible to have the case surcharge waived. insurance. Although guidelines vary by service provider as well as state schedule, many crash mercy programs are developed to waive the very first at-fault loss that occurs on your plan as well as will certainly waive just one loss within a specified duration, like 3 or 5 years.

However, the exact length of time relies on your state and the intensity of the occurrence. in New York State, a mishap or web traffic infraction will certainly remain on your record up until the end of the year when the occurrence happened, plus 3 years after. In Oregon, an accident or offense will stay on your record for five years.

Some Known Details About How Does A Car Accident Affect Your Car Insurance?

You can examine your state's Division of Car (DMV) internet site for info concerning driving record requirements where you live. low cost. Decreasing your auto insurance prices after a mishap, The bigger concern besides just how much your automobile insurance will certainly rise after a crash is exactly how do you get the least expensive possible premium since your accident is behind you.

"You might get approved for price cuts such as driving fewer miles, being a good pupil or having one in your home, and functioning in certain service-related occupations (such as teaching, healthcare, or the army)."Below are some ways to lower your vehicle insurance coverage price after a crash: Your credit rating contributes in determining your car insurance coverage rate, however not all states enable the use of credit history as a rating aspect for insurance policy. automobile.

It's constantly an excellent idea to go shopping around as well as locate the very best costs presently being supplied from various car insurer. cheapest auto insurance. It may be tough to find a cars and truck insurance coverage that supplies the very same coverage at the very same rate prior to an at-fault mishap, however you may likewise discover that insurance provider supply different discount rates as well as protection options.

You ought to constantly examine these adjustments with a licensed agent, reducing the amount of insurance policy you have could lower your costs. You will still need to keep your state's minimum called for protection levels, and if you have a lending or lease, you will certainly need to maintain full coverage on your vehicle, however you might be able to cut optional coverage selections (cheaper cars).

This comes down to security scores, products, price of repair service as well as several other aspects. By utilizing one or more of these techniques, you can assist reduce the sting of higher prices after an accident.

Unknown Facts About Will My Auto Rate Increase After Filing A Claim? - Travelers ...

automobile low-cost auto insurance vehicle auto insurance

automobile low-cost auto insurance vehicle auto insurance

These are example rates as well as should just be made use of for comparative functions. Prices were computed by reviewing our base account with the following events used: tidy document (base) as well as at-fault mishap.

Car insurance policy rates can increase 51% a year generally if you trigger an accident, Geek, Purse's evaluation discovered. If you change to the least expensive insurer in your state, you might discover much better prices. See what you might save money on car insurance, Easily compare customized rates to see just how much switching vehicle insurance coverage might save you.

cheapest car insurance credit score cars suvs

cheapest car insurance credit score cars suvs

Also if it was a minor collision, insurance companies regard you as a greater risk and also will certainly generally enhance your rates - cheap. To provide you a much better suggestion of exactly how a lot extra you'll pay after an accident, Geek, Budget compared ordinary automobile insurance prices across the country for 35-year-old motorists with a recent at-fault accident to those with no recent mishaps, maintaining all various other factors the same.

Nationwide, a chauffeur with an at-fault mishap pays $832 more a year on typical than a vehicle driver with no traffic violations. In 44 states and Washington, D.C., typical annual prices were more than $500 higher for drivers who 'd caused a current crash than for those who had not. In 18 states, average rates raised at least 50% after an at-fault accident.

Nonetheless, these are based upon ordinary rates. Your price may differ depending upon aspects like your age, place and insurance firm. The ideal insurance coverage for you in 2022Use our Best-Of Honors list to obtain the year's finest car as well as term life insurance policy. Affordable automobile insurance after an accident by business, Cars and truck insurance firms have hugely various point of views on how much to elevate rates as a result of a collision.

How Accidents Affect Your Insurance Premiums - Ama Things To Know Before You Get This

credit score perks prices money

credit score perks prices money

At the other extreme, we discovered several firms with rates more than two times as high for a chauffeur who had actually caused an accident than for a similar chauffeur that had not. As well as in a pair instances, average rates were greater than $2,000 a year higher after an at-fault crash. trucks. State Ranch, Geico, Progressive and also Allstate, the country's 4 largest vehicle insurer, with each other make up even more than half of the automobile insurance market.

To see just how the biggest insurers cost policies after at-fault Find more information crashes, we checked out ordinary prices throughout 45 states and Washington, D.C., where we have prices for all 4 of the biggest firms - insurance affordable. State Farm returned the most affordable typical rates for drivers who had actually created a mishap, in addition to for vehicle drivers that had not, and additionally showed the smallest percentage rise in rates between vehicle drivers with a clean record as well as those with a current accident.

Inexpensive auto insurance policy after an accident by state, Wondering which firms are the most likely to offer low-cost automobile insurance after a collision? Find your state listed below to see the least expensive automobile insurance coverage prices after an accident on ordinary based on where you live. Typical yearly price after a crash, Southern Ranch Bureau Casualty, Southern Ranch Bureau Casualty, Farmers Mutual of Nebraska, See what you could save on automobile insurance policy, Quickly contrast personalized prices to see just how much changing automobile insurance coverage can conserve you.

Our analysis shows that purchasing the most inexpensive feasible rate after an accident could possibly save you greater than $1,350 a year, depending on your state. No single cars and truck insurer is cheapest for everyone. Throughout all 50 states and also Washington, D.C., 23 various insurance firms connected for most inexpensive choice after an accident.

A study by the Consumer Federation of America discovered that some companies raise prices 10% or even more for not-at-fault crashes. In the 12 no-fault states, everyone entailed in an accident submits an insurance claim to their own insurance company for injuries. Due to this, homeowners of those states are more probable to see price rises after an accident, no issue who is at mistake.

Fascination About How Much Does Insurance Go Up After An Accident In 2022?

As well as a couple of states, consisting of Oklahoma and California, don't enable insurance firms to boost your rates if a crash was not your mistake. Some companies, such as USAA, also claim they will not increase rates if you aren't liable for a mishap. Regardless of whether the mishap was your fault, it's always a great idea to contrast auto insurance policy prices quote to ensure you're obtaining the lowest cost.

High-risk chauffeurs typically have a more difficult time finding protection since they are thought about high-risk to insure. If no one will certainly market you a plan, you may need to look for a state-run designated threat strategy - cheapest car.

To find out more, please see our and also The economic results of a crash can stick with you for several years, but it does not last permanently. Normally, accidents as well as traffic violations stay on your driving document for three to 5 years. The even more accidents or tickets you carry your driving document, the higher your automobile insurance policy costs will be.

, an insurance expert and also host of the "Money Woman" podcast (risks). While that is commonly an unpreventable consequence, you can take action right away to mitigate the unfavorable impacts.

"Stay violation-free and also accident-free in order to stay clear of the undesirable experience of beginning the clock over."After that, it's time to go online or grab the phone, as well as lessen the effects to your insurance coverage price. Here's what you require to understand about what occurs to your automobile insurance after a mishap. auto.

Car Insurance Claims - Everything You Need To Know - Uswitch ... - The Facts

"Mishaps are commonly a lot more costly than relocating violations. insurance."Most states make use of a factor system to track offenses by chauffeurs, as well as commonly, factors will certainly build up on your driving document if you're in an at-fault crash or a number of, or if you're founded guilty of certain traffic offenses. "It's the points on your driving document that the insurance provider see as a warning and also a reason to raise your prices," states Adams.

Why Do Insurance Rates Go Up After an Accident? The more driving threat you show, the extra you might have to pay for your auto insurance policy costs. Your insurance firm will adjust your prices after a crash to show any new details they have on your driving history.

Some insurance companies use it as a free benefit to dedicated consumers with good driving records. With some providers, brand-new chauffeurs or chauffeurs with bad driving records might have to pay a regular monthly charge to be enrolled.

An additional accident or infraction on your document during that duration might be especially costly.: Beyond discount rates, you can constantly consider changing your protections as well as deductibles to bring your auto costs more in accordance with your budget plan. However take care when considering your options; you intend to see to it you have enough coverage to shield on your own.

The golden state car insurance policy price increases for crash claims is something that I get inquired about regularly as an automobile accident lawyer - auto insurance. Because the Golden State has one of the highest costs of cars and truck insurance, several people are worried that they may encounter a rate hike in their premiums if they submit an insurance claim for injury and/or residential property damages after a cars and truck crash.

The 6-Second Trick For How Much Does Insurance Go Up After Accidents? - Time

As a matter of fact, this is Under essential stipulations of The golden state Insurance Code 1861. 02, the prices of costs for vehicle insurance policy for policy owners in CA may only be figured out by the following elements: The "insured's driving safety record"; The "variety of miles she or he drives yearly"; and, The "variety of years of driving experience the insured has actually had . car..."One of the most important factor taken into consideration is the initial of these (i.

insurance company vehicle insurance cheaper car insurance cheaper cars

insurance company vehicle insurance cheaper car insurance cheaper cars

Undoubtedly, if the crash for which a claim is being made is no fault of your own, this should not form a basis for any type of rise in insurance rates. cheap. In addition, as I have actually mentioned in prior post (see right here), California is a comparative fault territory, which implies that even if some part of mistake exists with one celebration, this doesn't imply they can not sue for injury.